Quality Businesses Patient Capital Proven Principles

JFD Capital invests in high-quality, publicly-traded businesses acquired at meaningful discounts to intrinsic value. Guided by time-tested principles and a long-term ownership mindset, we aim to preserve and grow capital through a focused portfolio of 10 to 20 carefully selected holdings.

Investment Philosophy

“Time is the friend of the wonderful business, the enemy of the mediocre.”

– Warren Buffett

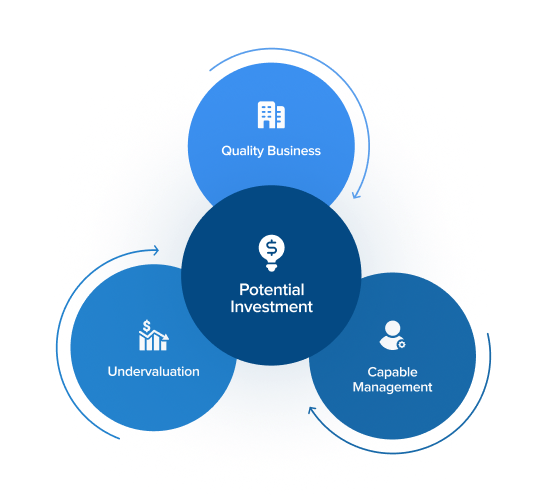

We believe client capital is most prudently invested in undervalued businesses with strong, enduring economics and capable, trustworthy management over a long-term time horizon. Characteristics of the businesses we seek to own include:

- Durable competitive advantages

- Increasing demand for products or services

- High margins and strong free cash flow

- Dominant market share

- Exceptional financial strength

- Capable, trustworthy management

- Discount to underlying value

By identifying the trifecta of business quality, management capability, and attractive valuation, we establish the foundation for every compelling investment opportunity. This disciplined approach allows us to invest with conviction during times of market stress:

Research Process

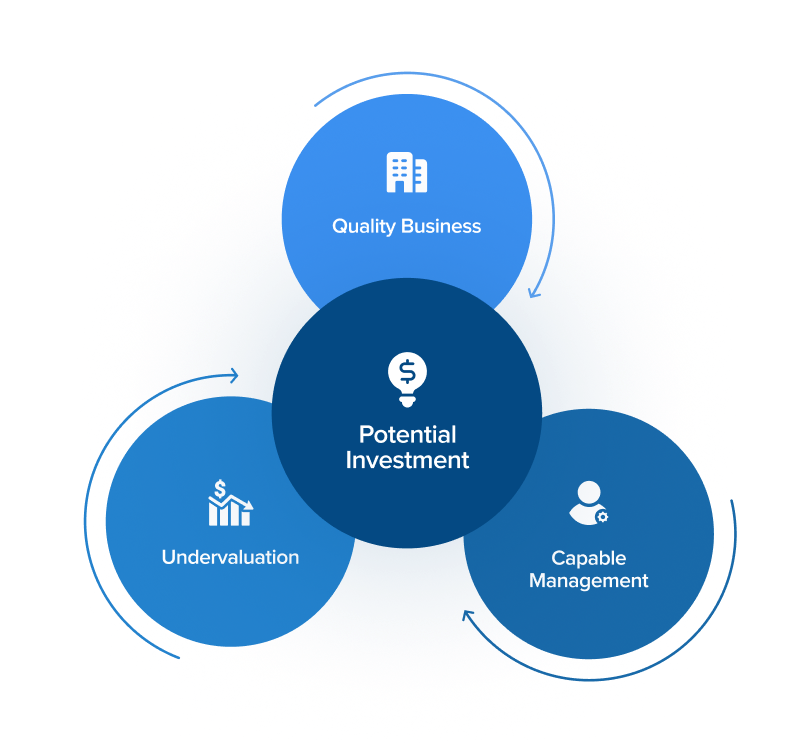

We utilize a multi-stage, proprietary research process to narrow down the universe of over 4,000 publicly-traded businesses into a focused portfolio of 10 to 20 high-conviction investments that meet our strict criteria:

Total universe of publicly-traded stocks

(4,300 in total)

Quality filtering over years of research

(250 in total)

Valuation filtering

(Varies in total)

Optimized Portfolio

(10 – 20 names)

Our deep commitment to research extends to portfolio management. Once a security enters our portfolio, it is rigorously monitored to ensure the investment thesis remains intact. This includes analyzing company and competitor quarterly earnings releases, investor presentations, industry trends, and news.

The JFD Capital Difference

At many advisory firms, investment research is outsourced or treated as a secondary concern. At JFD Capital, it’s the core of everything we do. We build lasting wealth not through surface-level analysis, but through deep, independent research and carefully selected investments.

Here’s how we are different:

- JFD Capital

- Typical Firm

Value Proposition:

- Superior investments, carefully researched

- Wealth & Estate planning

Portfolio Structure:

- Concentrated in best ideas

- Broad allocation diluting best ideas

Manager Experience:

- Entire career 100% focused on research

- Career spread across various roles. Scattered focus

- Net worth invested alongside clients

- Limited or no "skin in the game"

Firm Dynamics:

- Best interest of clients drives decisions

- Conflict between client interests and firm stability

- Client has direct access to decision-maker

- Client has limited or no access to decision-maker

Research:

- Proprietary, in-house database

- Often outsourced or uninformed

- Intimate knowledge and context

- Surface-level insight

Network:

- Extensive Network: New ideas / information sharing

- Limited network. Internally-focused mentality

Decision Making:

- Sole decision-maker

- Outsourced or committee approach with opinion “dilution”

- Extreme patience with ability to act quickly

- Analysts eager to justify existence with portfolio additions

JFD Capital

Typical Firm

Value Proposition:

- Superior investments, carefully researched

- Wealth & Estate planning

Portfolio:

- Concentrated in best ideas

- Broad allocation diluting best ideas

Manager:

- Entire career 100% focused on research

- Net worth invested alongside clients

- Career spread across various roles. Scattered focus

- Limited or no "skin in the game"

Firm Dynamics:

- Best interest of clients drives decisions

- Client has direct access to decision-maker

- Conflict between client interests and firm stability

- Client has limited or no access to decision-maker

Research:

- Proprietary, in-house database

- Intimate knowledge and context

- Research exclusively on compelling ideas

- Proprietary, in-house database

-

Intimate knowledge and context

Generalist analyst

Research exclusively on compelling ideas

- Often outsourced or uninformed

- Surface-level insight

- Research assigned to keep large teams busy

- Outsourced. Uninformed

-

Limited insight

Minimal experience. Or siloed focus

Research assigned to keep large teams busy

Extensive Network:

- New ideas / info sharing / Devil’s Advocate

- Limited network. Internally-focused mentality

Decision Making:

- Sole decision-maker

- Patience with ability to act quickly

- Focus on best ideas for clients

- Sole decision-maker

-

Extreme patience with ability to act quickly

Focus on best ideas for client

- Committee with opinion "dilution"

- Analysts eager for portfolio additions

- Analysts' motivation is to investigate "sexiest" ideas

- Outsourced or committee approach with opinion "dilution"

- Analysts eager to justify existence with portfolio additions.

Message from the Founder

Thank you for your interest in JFD Capital. As a brief introduction, I have spent the majority of my 25-year professional career in senior investment roles as Chief Investment Officer, Director of Research, and Portfolio Manager at two well-established investment firms, each overseeing more than $1.5 billion in assets under management. My investment journey began in 1998, when I first encountered a book about Warren Buffett and his business partner, the late Charlie Munger. I was captivated by their investment philosophy, which was straightforward, unconventional, and timeless — qualities that made it not only compelling but also replicable.

After dedicating over two decades mastering their investment philosophy, rigorously studying thousands of publicly-traded businesses, and managing multi-million-dollar portfolios, I founded JFD Capital. At JFD Capital, we are committed to growing your wealth by investing in concentrated portfolios of high-quality businesses with exceptional long-term potential, all the while sidestepping the common pitfalls that often plague professional investment management.

If you are an accredited investor and our philosophy resonates with you, I would welcome the opportunity to connect. Please feel free to reach out via email at info@jfdcapital.com or call me directly on 415-637-6664.